Negotiating Your Contract Pay

Being part of a meeting to discuss payments can be a little daunting and nerve-wracking but it’s also a great time to demonstrate your value

In a few short weeks we’re expecting an increase in in the National Minimum Wage and in turn the National Living Wage.

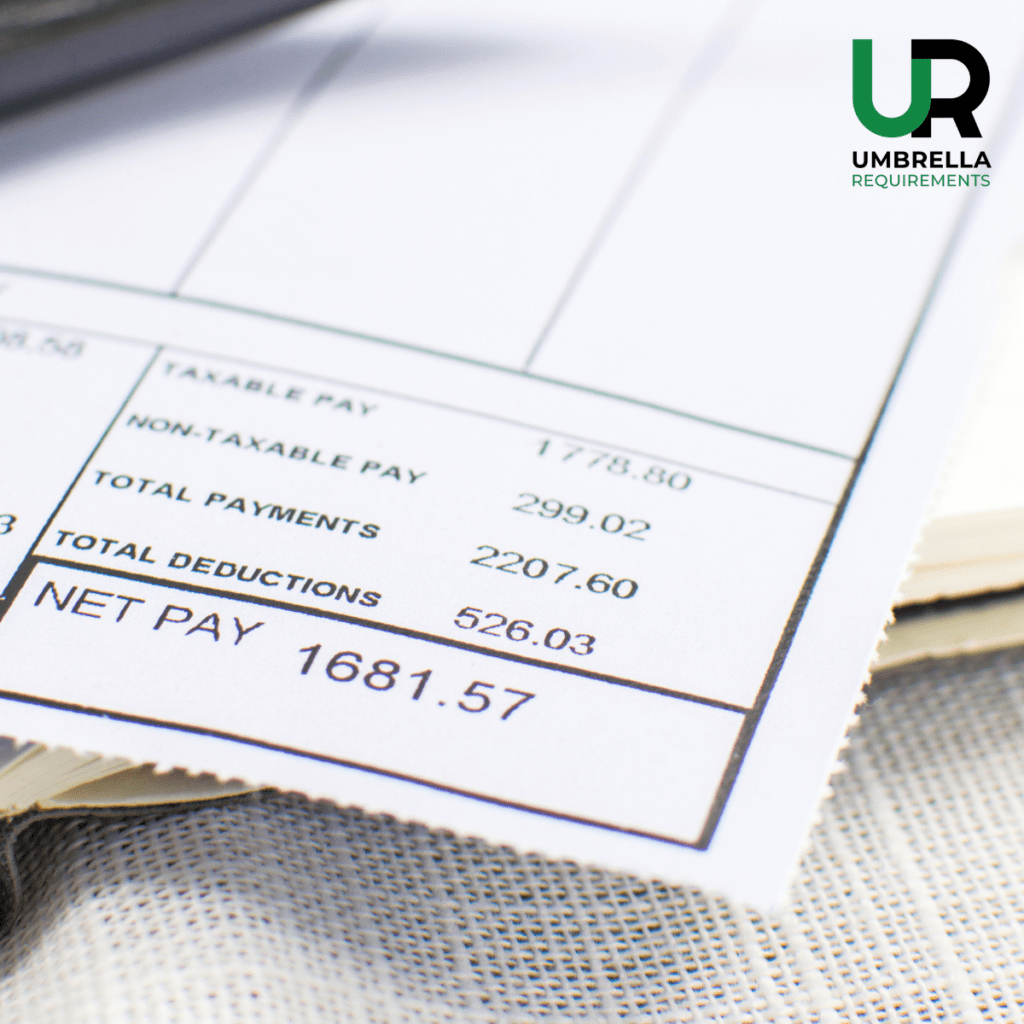

From April 1st 2023 the following hourly rates will be true:

Apprentice Rate: Increased by 47p to £5.28

16-17 Year Old Rate: Increased by 47p to £5.28

18-20 Year Old Rate: Increased by 66p to £7.49

21-22 Year Old Rate: Increased by £1.00 to £10.18

National Minimum Wage: Increased by 92p to £10.42

This means that all rates are increasing 9.7% with the exception of 21-22 year old workers who are seeing a 10.9% jump.

There is of course the proposed ‘Real living wage’ which is set by the Living Wage Foundation – in April 2023 this is set to be £10.90 for the majority of the UK and £11.95 in London. An indication that despite the increases many individuals will still be earning below the Real Living Wage.

If you’re on a standard tax code your personal tax allowance will remain frozen at £12,750. This is the amount you can earn before paying tax. Other tax codes can be seen on the government website. (Please note if you are in Scotland, the tax brackets are slightly different.) There are many variables that can affect the calculation of your personal allowance, you should review your tax code carefully and contact HMRC directly if you feel it may be incorrect.

If you have questions relating to the increase in National Minimum Wage in 2023 please don’t hesitate to contact us or jump on to the Government webpage that covers all aspects in great detail: https://www.gov.uk/government/publications/minimum-wage-rates-for-2023

Being part of a meeting to discuss payments can be a little daunting and nerve-wracking but it’s also a great time to demonstrate your value

Working as a contractor has many benefits but in some areas, it does require a little more work, especially when it comes to services providing

So, you’ve taken the plunge into contracting and now you need to get your employment affairs in order. You’ll likely be applying for lots of

6 Reasons to Question: Do Current Umbrella Certifications Carry Any Actual Assurance. In the relatively small world of UK umbrella companies, there exists a few

© 2022 Umbrella Requirements Ltd. All Rights Reserved. Company Number: 8184119